14 Jul Values Will Not Plunge

While there is no crystal ball, one local economist here in Southern California shares why he believes values will not suffer drastically. Interesting read.

Written by Steven Thomas

According to the researchers at the Penn State University, only 8% of the things that people worry about come true. From finances to job security to relationship to health, worry is everywhere. The collective mind seems to almost always jump to the worst-case scenario. It seems as if nobody is immune to worry.

With strong inflation numbers, Wall Street volatility, and soaring interest rates, panic and worry is in the air. So many are jumping to the immediate conclusion that as housing slows, values will eventually plunge like they did during the Great Recession. They recall how home values surged from 2000 to 2006, only to plummet after the subprime meltdown in March 2007. Everyone remembers the deep scars from the worst recession since the Great Depression.

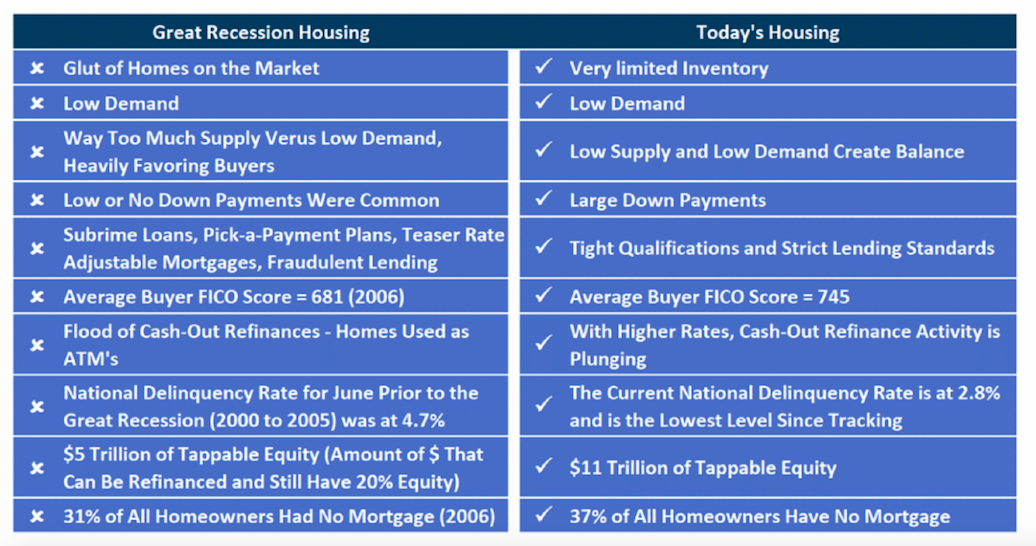

Even though so many are anticipating and reporting that a housing crash is imminent, it simply is not going to occur, not now and not in the foreseeable future. Why not? Collectively, homeowners across the country were sitting in a much different position prior to the Great Recession compared to where they stand today. To best understand the differences let us take a closer look and compare the two.

First, the direction of housing has everything to do with supply and demand. Prior to the Great Recession, the inventory climbed to over 5 times where it stands today. There was a glut of homes on the market. Like today, demand was muted, but was due to the deterioration of lending standards. When low demand was pit against a glut of available homes, the market lined up heavily in favor of buyers and prices sank. Back then there were low or no down payments, fraudulent lending practices, and loose lending standards and programs, allowing anyone to get a loan and purchase a home. The average buyer FICO score was 681. Today, buyers are purchasing with higher down payments, tight qualification and lending standards, and the average FICO score for buyers is 745. Cash-out refinances accumulated for years leading up to the Great Recession. Yet, today, pulling cash out has been plunging as rates have climbed. There is plenty of tappable equity and there are far more homeowners who own their homes free and clear.

In 2007, homeowners were upside down, owing more than their homes were worth. Banks were in control of the housing market as there was a wave of foreclosures and short sales that lasted years because of enduring poor lending standards. Today, the delinquency rate is at its lowest since tracking, much lower than the average from 2000-2005.

Looking at now versus then side by side it is easy to understand why the 2 time periods are completely different. Since the Great Recession, homebuyers have been stronger. With the vast majority of homes sold over the last couple of years procuring multiple offers, Darwinism has taken place, survival of the fittest. Only the strongest buyers have been winning: strong credit, money in the bank, good jobs.

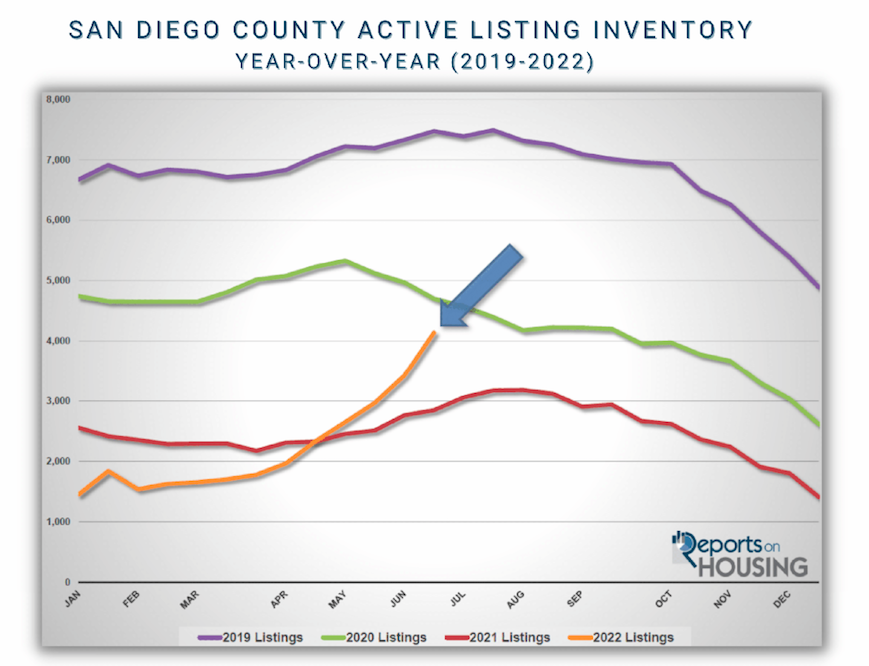

It will be impossible to build an inventory that resembled the glut of homes available from 2006-2011. Today’s 4,140 home level is 79% less than the height reached in 2007 of nearly 20,000 homes. The inventory right now in San Diego County is 39% less than the 3 year average of 6,823 between 2017 and 2019, when things were normal prior to COVID. And, back then, home values were methodically climbing each year.

Yes, supply is rising. Demand is muted. The housing market is slowing. The number of offers received is dropping. The number of offers over the asking price is falling. Sales are down. The number of price reductions has been steadily climbing. The pace of housing, the Expected Market Time (the amount of time between hammering in the FOR SALE sign to opening escrow) has slipped from an insane Seller’s Market (less than 40 days) in March when it was 18 days to a hot Seller’s Market (between 40 and 60 days) today at 56 days. It is about to slip into a slight Seller’s Market (from 60 to 90 days). Later this year it will decelerate to a Balanced Market (between 90 and 120 days), a market that does not favor buyers or sellers. And, if mortgage rates remain elevated above 5.5% with duration it will most likely become a slight Buyer’s Market (between 120-150 days) by year’s end. Yet, in 2007, the Expected Market Time surpassed 400 days in San Diego County, a deep Buyer’s Market (over 150 days), when home values sank.

Even if housing were to slip into a slight Buyer’s Market, it would have to be at those levels for months before prices start to decline. And any declines would be small. There is a real stickiness to home values. Very few sellers really “have to” sell. Homeowners are in a very strong position with plenty of equity, low mortgage rates, high credit scores, good jobs, and money in the bank. There will be no reason to panic. Values will not plunge.

If you or anyone you know is looking to buy or sell their home, give us a call!

760-214-1802