07 Jan Where Are We Headed In 2024?

According to the latest data from Fannie Mae, 23% of Americans think home prices will go down over the next twelve months, but why do roughly 1 in 4 people feel that way?

It has a lot to do with all of the negative talk about home prices over the past year. Since late 2022, the media has created a lot of fear about a price crash and those concerns are still lingering. That then floods the more casual outlets like social media…and soon enough, that influence has spread.

Ask yourself this: Which is a more reliable place to get your information – clickbait headlines and social media or a trusted expert on the housing market?

The answer is simple. Listen to the professionals who specialize in the residential real estate industry.

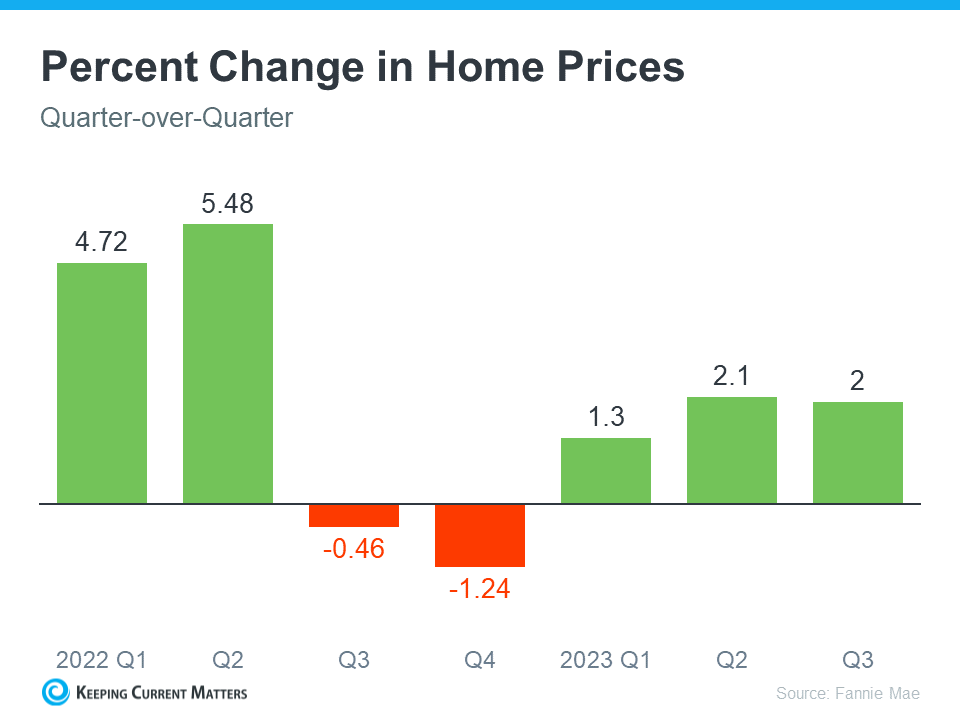

Here’s the latest data you can actually rely on. Housing market experts acknowledge that nationally prices did dip down slightly in the latter part of 2022, but that was short-lived. Data shows prices rebounded throughout 2023 (see graph below):

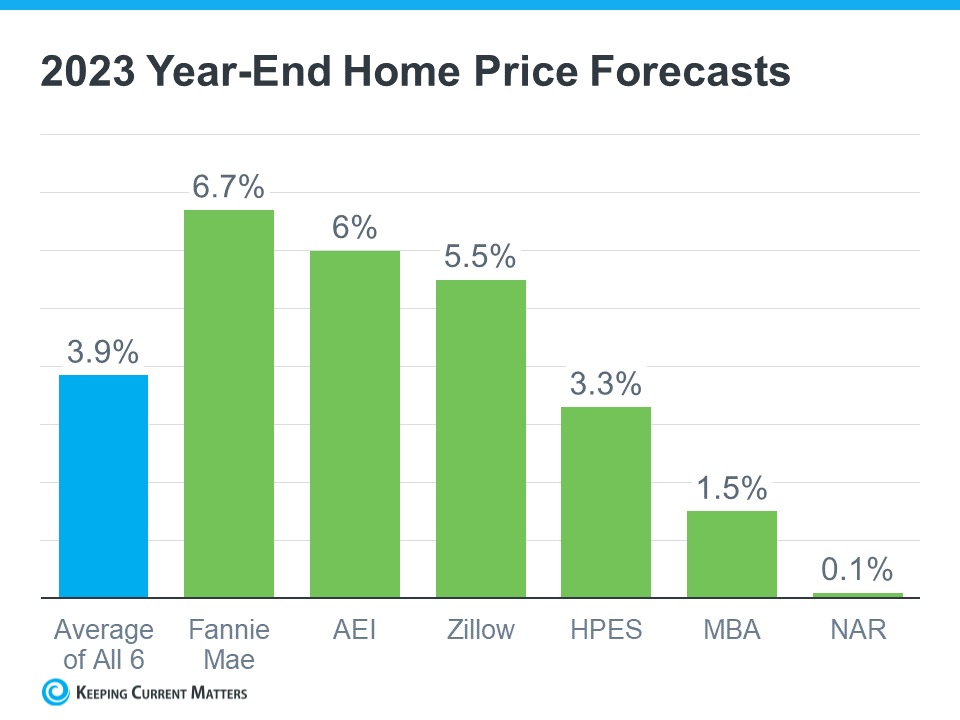

It is not only Fannie Mae that’s reporting this bounce back, but specialists from across the industry are showing it in their data too. That is why so many forecasts now project home prices will continue to net positive in 2024, since the market has not seen a major shift in inventory, and interest rates have been inching down. Both of these factors will continue to drive the market upward in 2024 and bring more buyers and sellers to the surface. The graph below helps prove this point with the latest forecasts from each organization:

What’s worth noting is that, just a few weeks ago, the Fannie Mae forecast was showing a 3.9% appreciation in 2023. In the forecast that just came out, that projection was updated from 3.9% to 6.7% for the year. This increase goes to show just how confident experts are that home prices will continue to net positive this coming year.

So, if you believe home prices are falling, it may be time to get your insights from the experts instead – and they’re saying prices aren’t falling, they’re climbing.

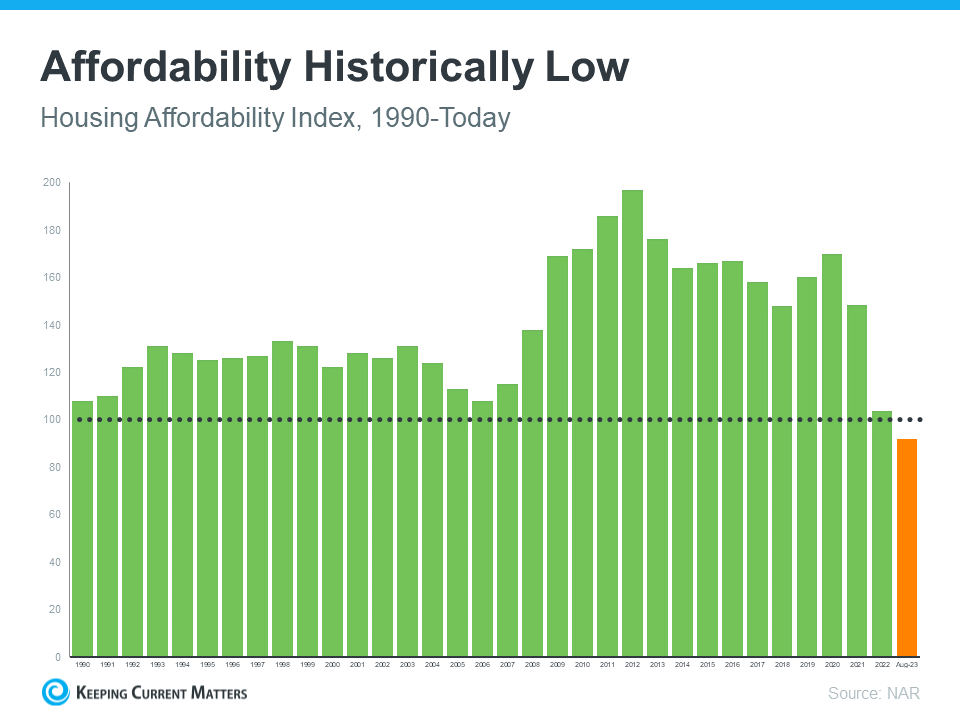

With that said, we then have to consider the affordability factor…it is true, over the past year we had some of the highest mortgage rates that we’ve seen in a while, causing many buyers to “wait it out.” But people are still moving, despite the affordability challenges that we’ve seen this past year. The graph below breaks down how the current affordability situation stacks up to recent years.

The National Association of Realtors (NAR) explains how to read the values on the graph:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home.”

The black dotted line represents that 100 value on the index. Essentially, the higher the bar, the more affordable homes are. As you can see, the orange bar for Aug. of 2023 shows that higher mortgage rates and home prices have created a clear challenge. But, while affordability is definitely tighter right now, that doesn’t mean the housing market is at a standstill.

According to NAR, based on the pace of sales for this past year, just under 4 million homes were sold in 2023. With some simple math, let’s break down what that really means:

- 3.96 million homes divided by 365 days in a year = 10,849 houses sell each day

- 10,849 divided by 24 hours in a day = 452 houses sell per hour

- 452 divided by 60 minutes in an hour = about 8 houses sell each minute

So, on average, almost 11,000 homes sell each day in this country!

This goes to show that there are over 4 million other buyers and sellers that are not letting the challenges of the market hold them back. They are the ones who will benefit, as they see their financial assets grow and gain equity over the years, while the 23% of Americans who still think that prices will fall over the next 12-months will possibly continue to sit on the sidelines and wait. Unfortunately, this group will miss out on the opportunity to strengthen their financial status through homeownership and pay more in the long run. Experts predict home prices will continue to rise in 2024 due to the low inventory and more demand with lower interest rates.

An experienced and qualified agent can help you make your move a reality!

If you’re hoping to buy or sell a home today, just know that other people are still making their goals a reality – and that’s happening largely because of the help and advice of skilled real estate agents. Your trusted team at Colucci & Co. Reality is here to help you navigate today’s market and our expert advice and helpful resources are invaluable. As true professionals, we will be able to offer advice that is tailored to your specific wants, needs, budget, and more. Let us help make your dreams of buying or selling a home come true in 2024.

This article was provided with content from Keeping Current Matters, Inc & Colucci & Co. Realty Group. The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions.